Thumzup Media Corp., a struggling Los Angeles-based social media startup, has attracted headlines for stockpiling Bitcoin despite generating minimal revenue — and now, it has secured a major investment from Donald Trump Jr.

$4M Investment Despite Just $151 in Revenue

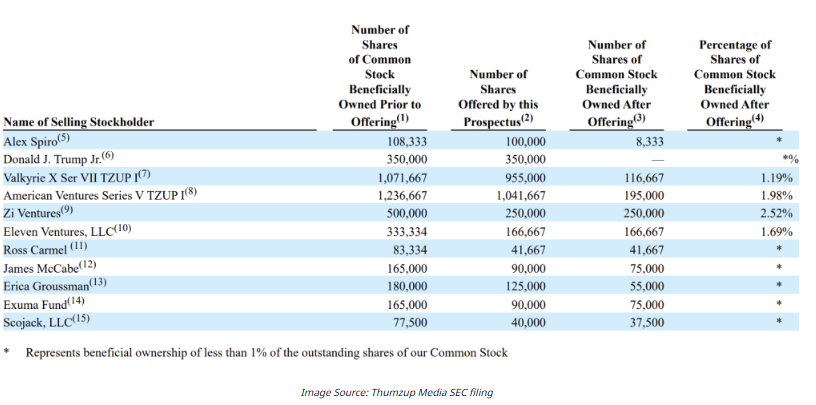

According to a filing on Wednesday, Donald Trump Jr. has purchased 350,000 shares of Thumzup, valued at over $4 million based on the previous closing price of $12.36 per share.

Notably, the company reported just $151 in revenue during the first quarter — alongside a $2.2 million net loss. Yet, its stock surged nearly 75% over the previous four sessions before dropping 17% midday Wednesday.

Trump Jr. reportedly made the investment on the advice of an advisor and holds no operational role in the company.

From Instagram Incentives to Bitcoin Reserves

Thumzup operates an app that pays users for recommending products on Instagram.

In January, the company made a dramatic pivot: it announced it would hold most of its liquid assets in Bitcoin. Since then, it has acquired over $2 million worth of BTC and now plans to expand its holdings to include six additional cryptocurrencies, funded through a recent capital raise.

Trump Family Deepens Crypto Ties

Trump Jr.’s investment adds to the Trump family’s increasing involvement in crypto ventures and Bitcoin treasury strategies.

Notable crypto-related activity includes:

- Advisory roles with Dominari Securities, which facilitated Thumzup’s private placement.

- Board positions in Metaplanet, a Japan-based firm embracing Bitcoin as a treasury asset.

- Participation in Trump Media & Technology Group, which announced a planned $2.3 billion Bitcoin allocation.

Meanwhile, Donald Trump, once a vocal crypto skeptic, has repositioned himself as a champion for digital assets, promising to make the U.S. the “crypto capital of the world.” His initiatives — including meme coins $TRUMP and $MELANIA, NFT collections, and ventures like World Liberty Financial — have reportedly generated close to $1 billion in revenue.

However, these intertwined business and political efforts have drawn scrutiny over potential conflicts of interest, insider governance, and controversial financial backers. Even so, they continue to benefit from a pro-crypto stance and increasing regulatory momentum.